Blog

A Wall Around Your Wealth: The Importance of Asset Protection

14/02/2023

Article By: AAG Advisor

Share!

Being wealthy and successful can put a target on your back for frivolous lawsuits. Asset protection planning can help you better safeguard your wealth. Check out some foundational asset protection strategies.

KEY TAKEAWAYS

- Asset protection strategies are designed to deter lawsuits and safeguard your assets.

- Far too many successful business owners don’t have an asset protection plan in place.

- Start with the basics, such as umbrella policies, and build from there if needed.

Success can come with a major downside: It can make you a potential magnet for lawsuits – including frivolous and unfounded ones – and other attacks that can wreak havoc on your financial health and stability.

Indeed, you may very well know someone in your life who has been sued. Maybe it was you!

That means you’ve got to take steps to protect the assets you’ve worked so hard to build from being unjustly taken. Otherwise, you may jeopardize your financial security and that of your company and your family.

Why you need asset protection

Asset protection planning as we define it is pre-litigation planning that is designed to deter lawsuits if possible – and if not, to encourage favorable settlements.

The logic of asset protection planning is clear: You build a wall around your wealth that is as difficult as legally possible for litigators, creditors and others to scale. Instead of trying to fight it out with you in court for months or years and risk losing, the litigant sees that the only reasonable option from a legal standpoint is to settle for pennies on the dollar – or, ideally, to leave empty-handed.

Important: Asset protection isn’t about “hiding money” from the world – quite the opposite, in fact. You want anyone who might come after your assets to clearly see what you have done to build a wall around your wealth. Why? It shows them the difficult legal path they’d have to take to get at that wealth – which, hopefully, will cause them to settle, negotiate, or (ideally) throw up their hands and walk away.

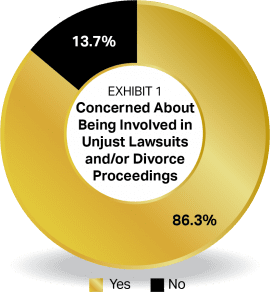

The good news is that the threats to your wealth from other people and entities are probably on your radar screen. Take successful business owners, for example. More than 85 percent of successful business owners say they are concerned about becoming the object of unjust lawsuits or being victimized in divorce proceedings (see Exhibit 1).

N = 262 successful business owners. Source: Russ Alan Prince and John J. Bowen Jr., Becoming Seriously Wealthy, AES Nation, 2017.

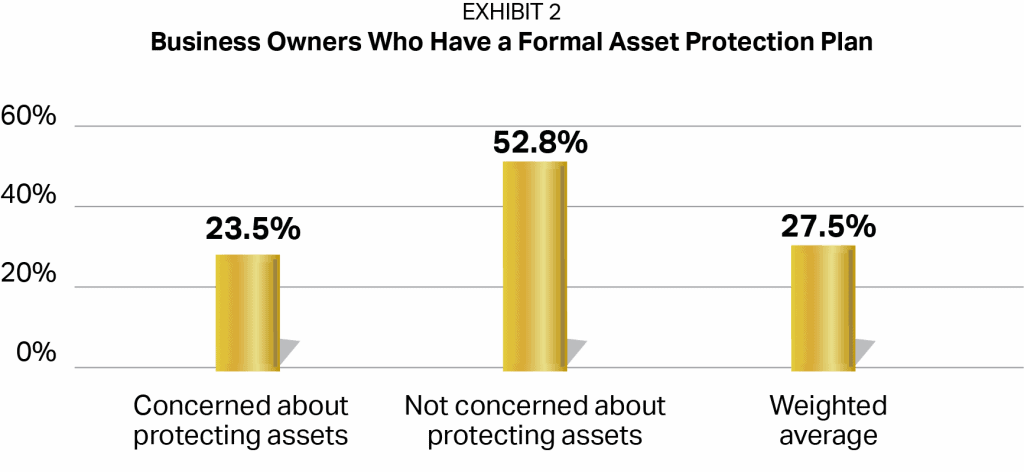

Here’s the bad news: Only about a quarter (27.5 percent) of successful business owners have a formal asset protection plan in place (see Exhibit 2). The percentage is even lower among those business owners who say they are concerned about protecting assets. Given the risks that our litigious culture presents, these numbers are likely far too low.

N = 262 successful business owners. Source: Russ Alan Prince and John J. Bowen Jr., Becoming Seriously Wealthy, AES Nation, 2017.

Note: Half of the successful business owners who are not concerned about protecting their assets do have formal asset protection plans in place. That makes sense to us: Having these plans may give business owners enhanced confidence they are well-protected – and allay their fears about being unjustly sued.

Five asset protection action steps

If you’re among the many successful people out there who lack an asset protection plan – or if you’re simply curious whether your existing plan is still as strong as it needs to be – consider taking a few key actions.

- Get protected before a claim against you is made.

You can do a lot to protect your wealth before a liability arises – but thanks to a concept known as “fraudulent conveyance,” very little can be done after. As with insurance, the time to have asset protection in place is well before you need it – or even think you might need it. - Cover the basics.

Evaluate your liability insurance and other related policies, and maximize them as best you can. Probably the fastest, easiest and cheapest move you can make is to take out a large umbrella policy to safeguard assets. Another simple but powerful strategy can be to place your assets in someone else’s name, such as your spouse’s. If you’re sued, those spouse-controlled assets are often untouchable.

Pro tip: Be sure you have a great deal of trust in your spouse and your marriage before transferring ownership of assets to him or her. In a divorce, your spouse could potentially walk away with those assets – or you could be forced to fight for them at least as hard as you’d fight a creditor who went after them.

- Consider a variety of other asset protection strategies.

The asset protection strategies you may need will depend on your specific situation, of course. That said, it’s generally a good idea to consider your options, which might include:- Ascertain appropriate utilization of risk transfer through property-casualty insurance (homeowner’s, auto, rental, personal excess liability [umbrella], health, disability, life, long-term care, directors’ liability and professional liability insurances).

- Use state law exemptions effectively (for example, the homestead exemption, cash value of life insurance policy, retirement plans and annuities).

- Consider various forms of ownership that either put assets beyond the reach of a creditor or make these assets less desirable for creditors.

- Examine restructuring your current business.

- Discuss gifting assets when there are no current creditor issues in order to lessen the likelihood of raising fraudulent transfer issues.

- Look into advanced protection strategies that are commonly used by people with extreme wealth – such as equity stripping or closely held insurance companies. These strategies may be more than you need, but it’s good to know they exist and whether they might be a good fit. If there’s a lot of risk attached to what you are doing as a business owner – the more your industry, company or competitors have gotten hit with lawsuits – then advanced asset protection planning strategies may be more applicable.

- Structure any expected gifts and/or inheritances to protect them from claims of creditors.

- Be sure your attorney or other professionals are qualified to help you protect your assets.

We see that far too many financial professionals aren’t in a position to provide guidance on and implementation of many asset protection solutions. Assess the asset protection expertise among your professionals – either the expertise they possess themselves or the resources they have access to via their professional networks of other experts. - Avoid big mistakes that will trip up your asset protection efforts.

Some asset protection strategies are complex and require a deep familiarity with and understanding of how they work in order to set up and execute them effectively. If poorly structured, asset protection strategies will have no “teeth” when they’re needed most – and business owners’ assets won’t be nearly as safe as they assume.Example: Most advisors don’t appreciate the need to protect business owners on both the professional side and the personal side. Take real estate developers, for example, who commonly place each of their development projects in separate limited liability companies (LLCs). That way, if one project incurs a lawsuit, the others are protected. The problem: Those LLCs are many times set up so the developers own them directly. If they get hit with a personal lawsuit – they’re involved in a drunk driving accident or their child smashes a car into a school bus – all those assets in the LLCs could be up for grabs in the lawsuit.

Conclusion

You can’t necessarily stop someone from suing you. But you can take steps that will make it harder for litigants to collect money from you unjustly – and maybe even prevent those litigants from coming after you in the first place.

When you think about how hard you’ve worked to grow your assets, we think you’ll agree that it makes sense to put strategies in place to protect them too.